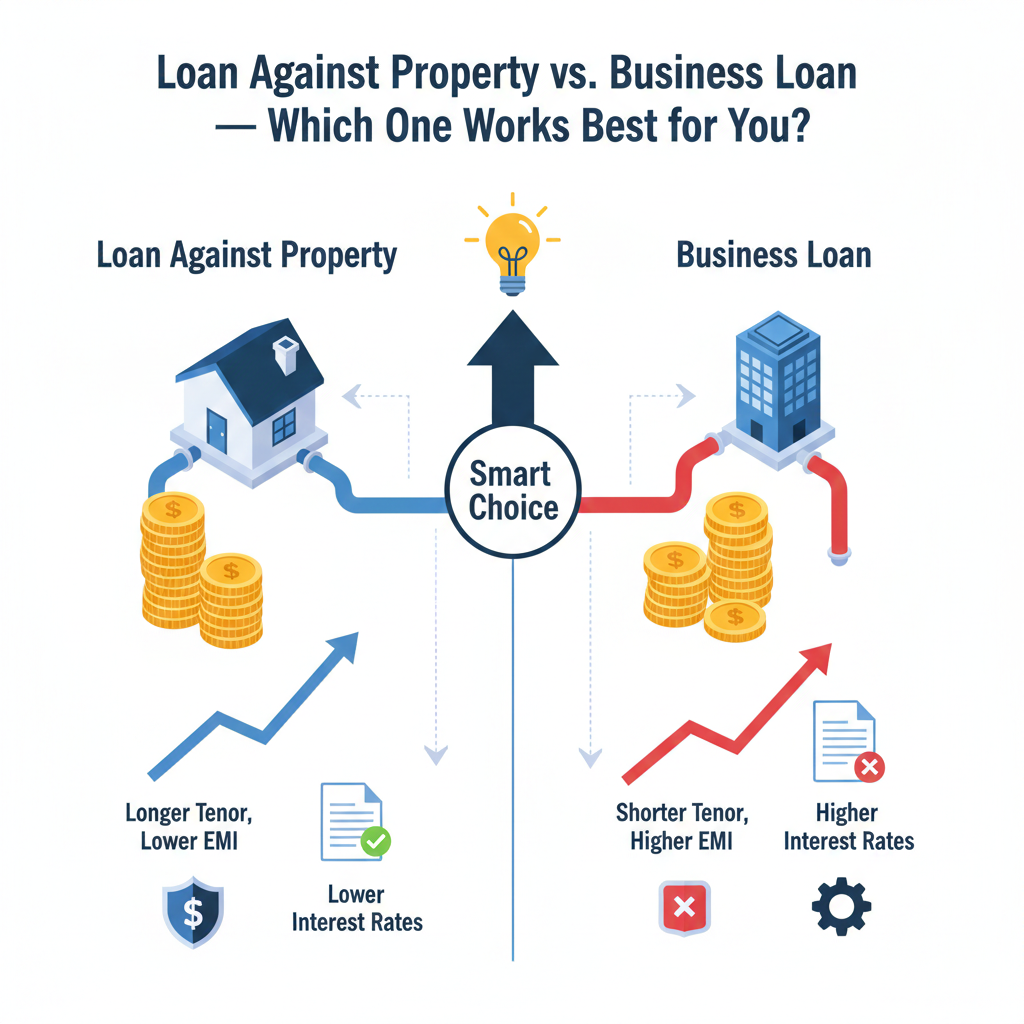

When your business needs funds, the two most common options are Loan Against Property (LAP) and a Business Loan.

Both serve the same goal — growth — but the way they help you achieve it is quite different.

Let’s explore how each works and which one may be right for you.

Loan Against Property (LAP): Turning Your Assets into Opportunities

Your property isn’t just a place — it’s an asset that can open doors to business growth.

With LAP, you can leverage your owned property (residential, commercial, or industrial) to get a high-value loan at competitive interest rates.

Key Benefits:

- Lower Interest Rates: Because it’s a secured loan, you enjoy better rates.

- Higher Loan Amounts: Based on your property’s value, you can get up to ₹50 Cr or more.

- Longer Tenure: Repay comfortably over 10–15 years.

- Flexible Usage: Fund your business, consolidate debts, or even meet personal financial needs.

Best For: Established businesses or individuals who own property and need a large sum for long-term goals.

Business Loan: Quick Capital, No Collateral

If you don’t want to pledge property or need immediate working capital, a Business Loan is the ideal choice.

These are unsecured, meaning you get quick access to funds purely based on your financials and credit profile.

Key Benefits:

- No Collateral Needed: Ideal for startups or asset-light businesses.

- Fast Processing: Quick approval and disbursal.

- Short Tenure Flexibility: Perfect for immediate or short-term business needs.

- Builds Credit History: Helps improve your business’s financial credibility.

Best For: Growing companies that value speed, simplicity, and flexibility.

Which One Should You Choose?

| Factor | Loan Against Property (LAP) | Business Loan |

|---|---|---|

| Collateral | Required (property) | Not required |

| Interest Rate | Lower | Slightly higher |

| Loan Amount | Higher | Moderate |

| Tenure | Long-term | Short to medium |

| Processing Time | Moderate | Fast |

| Best For | Long-term expansion | Short-term working capital |

Our Recommendation

If you need a large amount at a lower interest rate, LAP is your go-to.

But if you value speed and flexibility, a Business Loan will serve you better.

At PennyFarm Finance, we don’t believe in “one-size-fits-all.” Our team studies your business, goals, and repayment capacity to recommend the most effective financing solution — whether secured or unsecured.

Subscribe to Newsletter

Get the latest financial tips and insights delivered to your inbox