Running a business often means dealing with ups and downs in cash flow. Some months bring in strong revenue, while others may need a little extra push to manage working capital.

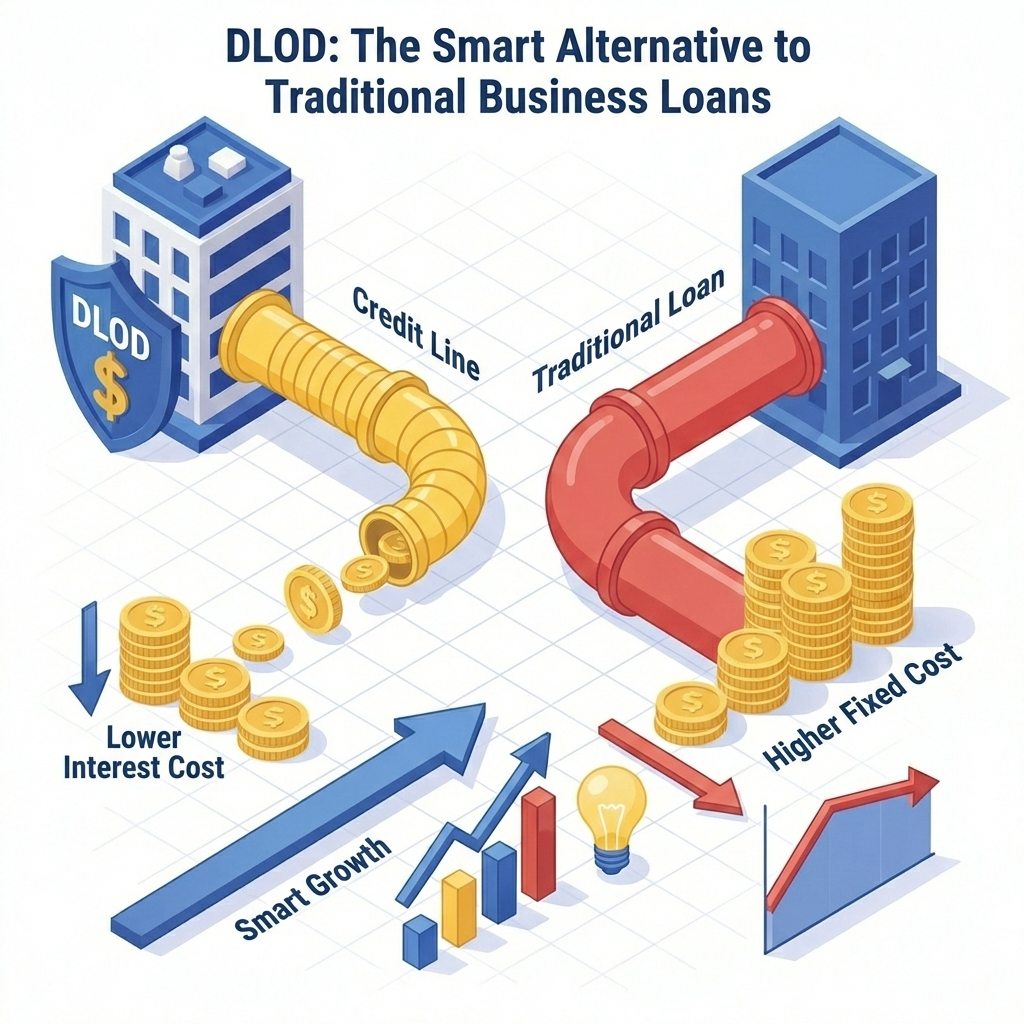

That’s where a Drop Line Overdraft (DLOD) comes in — a modern, flexible, and cost-effective solution for smart businesses.

Let’s understand why more and more business owners today are choosing DLOD over traditional business loans.

What Is a Drop Line Overdraft (DLOD)?

A Drop Line Overdraft is a credit limit offered for a specific tenure, where the available limit reduces (or “drops”) every month or quarter as you repay.

Unlike a term loan where you pay EMIs on the full amount, in a DLOD you pay interest only on the amount you actually use — making it a smarter, cheaper financing option.

How Does It Work?

For example, if your sanctioned limit is ₹50 lakh for 3 years, you can withdraw funds as and when needed, and as you repay, your available limit keeps reducing.

This gives you complete control over your cash flow and borrowing costs.

Top Benefits of a Drop Line Overdraft

1. Interest on Usage, Not Limit

You pay interest only on the funds utilized, not on the entire limit. That means you save more every month.

2. Flexible Withdrawals and Repayments

No fixed EMI pressure — withdraw when you need funds and repay as per your business inflow.

3. Cost-Effective for Working Capital

DLOD is perfect for managing operational costs, vendor payments, or seasonal cash flow gaps.

4. Secured Yet Flexible

It’s usually backed by property or business assets — which means lower interest rates than unsecured credit.

5. Ideal for MSMEs and Growing Businesses

Whether you’re scaling operations or managing short-term obligations, DLOD keeps your liquidity healthy without overburdening your balance sheet.

In a Nutshell

A Drop Line Overdraft gives you the freedom of a revolving credit line with the discipline of a reducing loan limit — a perfect balance of flexibility and responsibility.

At PennyFarm Finance, we help businesses choose and structure the right credit solutions to suit their growth needs — from DLOD and WCDL to unsecured funds and project finance.

Subscribe to Newsletter

Get the latest financial tips and insights delivered to your inbox